HERO - The Future of Banking in Southeast Asia Through Easier and Affordable Credit Token

Why am I contacting these countries? They are countries in Southeast Asia. Southeast Asia is the fastest growing region in the world. It makes the top 4 internet market in the world. Only 27% of Southeast Asians have bank accounts. Most Southeast Asians and Filipinos probably still do not have bank accounts, but they are internet users who are ready to get innovative solutions.

Present a smartcontract Token called Hero. Hero is the latest and the first banking from Southeast Asia decentralized using blockchain technology. Hero is here to revolutionize the banking industry to make credit more accessible and more affordable for not shared and backward in southeast asia. Unbanked is a person who has money but does not keep his money in the bank, underbanked exactly the opposite.

Mission and vision

Since 2015, we have helped thousands of Filipinos access short-term credits and their numbers are increasing rapidly. As an inner pioneer

Online loans in Southeast Asia, we have become one of Fintech's most prominent startups to disrupt the very thing

The lending industry is worth billions of dollars. Through our platform, we have provided a revolutionary solution for significant issues among the unbalanced and burdened in emerging markets.

Headquartered in Singapore, we operate online without branch infrastructure, enabling us to keep our operating costs low and stay focused on our customers. We turned the loan into a frameless, transparent, and highly efficient digital experience for Southeast Asia.

Our vision is to disrupt the current financial system that does not include 2 billion people from the banking system by using technology to create a more inclusive system that allows people to access credit.

How does it work?

Pawnshops in Everyone

PawnHero disrupts the traditional pawnshop experience by providing virtual and physical hybrid services. PawnHero

the operating platform ("Opus") combines an unhindered frontend frontend experience with backend operational processes

enables PawnHero to manage and control the customer and business experience.

Subscriber sends goods information ("Request") on pawn over their phone or desktop computer. After the customer sends their item details through a series of drop down menus, Opus connects the request to Magnus Loan pricing model which directly provides multiple loan offerings with different loan amounts to customers. Customers then choose their preferred loan offer and are guided through Customer Information, Payment Methods, and Shipping modules.

Opus then arranges PawnHero's motorcycle courier ("Pawnshop") to take the item from the customer's home at no cost to the customer. At pickup, PawnTrooper complements the legally required Know Your Customer (KYC) procedures, issues a pledge ticket to the customer, and receives the item for delivery to our Operation Center.

In the Operations Center, our expert appraiser authenticates the item and assesses the condition of the item. If the authenticity of the item is confirmed and the condition of the item is represented in the Request, then the loan is released through Opus to the preferred payment option selected by the customer. If the item is not authentic, the item is returned to the customer and the customer is charged 100 pesos (USD 2). If the item is genuine but not in the conditions represented in the Request, the appraiser will estimate the revised value of the item and Opus offers new loan offer via SMS and email to the customer. If the customer receives a revised offer, the loan is released via Opus to the preferred payment option selected by the customer. If a customer rejects a revised offer, the item is returned to the customer at no cost to the customer.

PawnHero stores the promised items at the Operation Center in a well-controlled and well-controlled safe. Opus tracks the movement of goods promised during the process until the goods are returned to the customer at the time of redemption by PawnTrooper or the goods are sold.

On or before the loan maturity date, the customer may, through various payment options, make a loan repayment payment or apply for a loan extension. If the customer fails to redeem or renew before the due date, the loan enters a period of legal notice of 1 month for electronic goods and up to 3 months for non-depositable items. Upon the completion of the notice period, if the customer does not make any repayments and additional interest payments are required, then Opus complements the general requirements and a valid auction process and then makes the item available for sale in our market.

PawnHero offers several payment options for loan repayment ("Pay Out") and repayment of loan and / or loan extension ("Pay In"). Major payment partners include Paynamics, which offers multiple over-the-counter transactions in national banks, and Pay In and Pay Out at various retail locations including leading goods stores such as 7/11 and other retail locations across the Philippines.

We also partner with a blockchain-capable platform that allows anyone, including those who do not have a bank account, to easily access financial services directly from their phone. By using Coins, customers have access to the wallet

Where we go

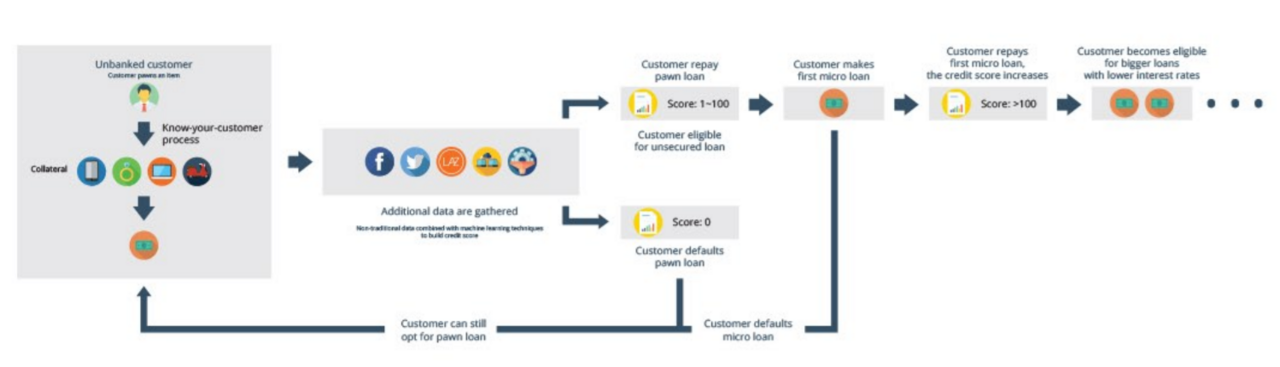

Understanding blockchain technology is not for the average person. We have repeatedly seen that poor people need an excuse to treat bitcoin as a currency. Unsold customers will not use bitcoin for its inherent coolness. Bitcoin eventually becomes a complicated concept, unless it is tied to a fiat currency or a trusted local mobile money system, has no value. Our core team has been living in emerging markets for many years and understands this challenge very well. We understand that there is an ecosystem in which it is received.

Hero uses blockchain bitcoin as a back-end for local currency transactions providing a clear way to ensure that customers can feel comfortable with their products, while also accepting the costs and benefits of technology from blockchain technology. Because we have a network of over 100,000 partners and vendors to provide easy-to-use cash / outgoing options that are understandable and reliable to mainstream consumers.

Competitor

Banks are very binary - yes or no. They do not have gray and you may have 9/10 requirements, but are at high risk and do not have access to the loan. We want to make sure that other factors in people's lives are taken into account when granting them access to credit.

Benefits of Blockchain

How did the blockchain begin to have a real meaning in the lives of two billion people excluded worldwide?

Blockchain could be the solution. First, this technology is a powerful new tool for improving financial inclusion, potentially disrupting many financial institutions and improving bank performance in the global economy. Underestimating traditional lending institutions and radically simplifying the process, blockchain can ultimately enable instant lending without shock, so people do not queue for an hour or more, take long trips, or live a risky life and limbs roam into dangerous environments at night only to get a loan

Second, will imp Second, will increase administrative accountability. If microcredit is recorded to blockchain and anyone can access it, then the loan can hold people who are more responsible for the bad behavior. Blockchain as a technology, has the potential to address all the innate intricacies of this lending process. With the inherent concept of open ledger, decentralized platform, smart contract and integrated central database, blockchain achieves transparency, cost effectiveness, regulatory compliance and risk analysis in the lending process.

By reducing manual review, data reconciliation and system reconciliation, the system provides cost savings to the company. The processing of loan data can be done exclusively on debit books that reduce risk and increase transparency and responsiveness, the technology itself functions like a rule.

Blockchain's technology creates a whole new, unimaginable business model, such as Hero, that empowers individuals and businesses.

Token Hero

What is a token sale?

This document provides a comprehensive overview of the Hero, its application and its benefits, the team involved in the project, the upcoming Hero fundraising (sometimes loosely called "ICO" or "crowdsale"), Corporations and goals expected by Hero.

A Token Sale is an event in which a new crypto-sell project sells a portion of its kriptocurrency token to early adopters and enthusiasts in return for funds. For those who offer tokens for sale, this has been a well-documented and respected way to raise funds for top-class products or services.

Why token sales?

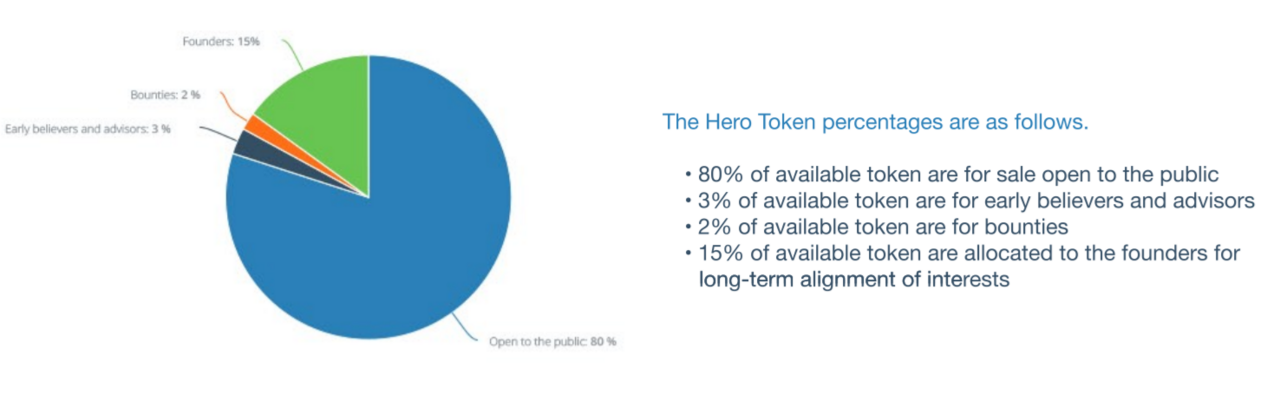

Although PawnHero already has central bank licenses, work products and thousands of customers, bringing PawnHero to the next level requires more capital to measure our impact. We need to continue to develop products, enter new markets and hire talented people to help build businesses. The sales results will enable us to accelerate the development of guaranteed and non-dualizable lending algorithms that require higher loan volumes than we can currently support.

Offering a token instead of a traditional venture capital turn allows the public to participate in PawnHero's success story, rather than restricting it to the small number of selected venture capital funds. By issuing the Hero token, the tokenholder will benefit from PawnHero's future success. Token sales are fast, transparent and efficient for this purpose appropriately.

Token Name

Hero Token (Symbol HERO) - The Future of Banking in Southeast Asia

The number of tokens made for the Hero chain all depend on how many coins were sold during the token sale. a maximum of 250,000 Ethereal tokens (ETH) will be accepted for the purchase of Hero tokens in the sale of this token. The maximum contribution amount in turn will represent 80% of all Hero tokens. Since we do not know the total to be sold, token sales operate on a percentage basis to ensure justice for all. If the maximum amount is reached before the end of the sale in TBD, which is 4 weeks after the start of the token sale, we will deduct the token sale. If the maximum amount is not funded entirely at the end of the token sale, the percentage of 80% of all tokens will be adjusted, with the difference between the lower amount and the maximum amount reserved for future token sales.

Hero is strategically designed to add value to the Hero network:

- Reward bearing tokens - like flowers

- Social impacts help underserved access to affordable credit

- Buy back: The company can use a profit percentage to buy back the Hero tokens from the open market at

- prevailing market prices, therefore the token value must be positively correlated further with the success of the project.

There is no risk of default interest on the mortgage loan granted by PawnHero. PawnHero withholds all interest due to the pawn loan term at the front by reducing the interest from the proceeds credited to the customer. For example, a 1,000 Philippine Peso (PHP) loan with a 3 month term and a monthly interest rate of 2.99% will generate 89.7 PHP interest. PawnHero just released 910.3 PHP to customers and thus collects 89.7 PHP full of interest without any risk of default interest. After a 3 month loan period, customers are required to redeem loans by paying 1,000 PHP. Depending on the underlying guarantee, PawnHero offers the customer to extend the loan at which additional extension of the loan extension arises where additional interest is due. Investors receive 20% of the collected interest. So that is 20% of 89.7 PHP. For each monthly quarterly interest, the sum of all loans disposed in the period used.

To participate in the sale of Hero tokens you can send the following currency from a wallet that you control directly (do not send from an exchange) to Hero's wallet.

- Ethereum (ETH)

- ETH Classic

- Bitcoin (BTC)

- Ripple

- LiteCoin

- Waves

The wallet address will be available on our website www.herotoken.io before the actual token sale. The hero's token will be sent to the buyer after the end of the token sale. Transferability will start from the first day of trading, which is planned to begin after the token sale ends in September. After selling this token, no additional Hero tokens will be created.

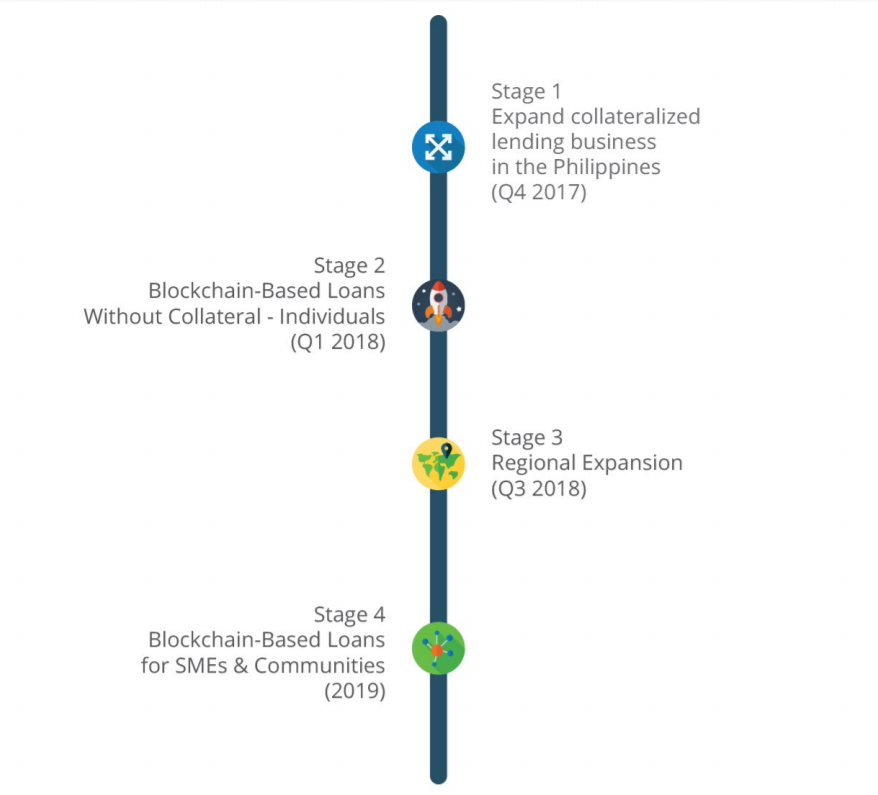

Roadmap

more info:

Website: https://www.herotoken.io/

Bitcointalk ANN THREAD: https://bitcointalk.org/index.php?topic=2073049

Facebook: https://www.facebook.com/PawnHero.ph

Twitter: https://twitter.com/PawnHeroPH

Telegram: https://t.me/herotoken

ETH: 0x10D894668E0fFb6142B8d72c8AA1BDa3702701B0

Komentar

Posting Komentar